April-June Q2 CY2025 HIGHLIGHTS

All values are Y-o-Y with April-June Q2 CY2024 comparison

- Orders declined due to the impact of large order timing, while base orders increased

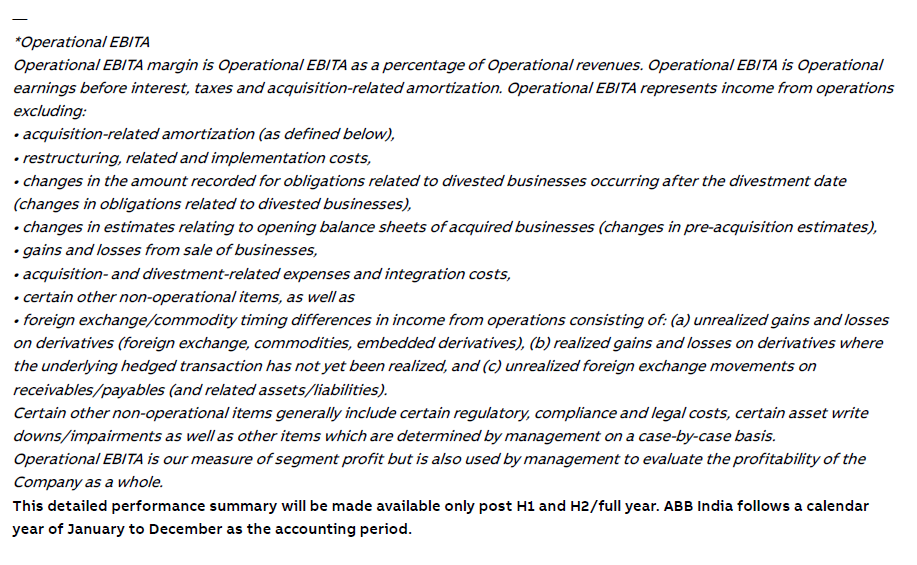

- Revenue growth stood at +12% for the quarter and +7% for H1 CY2025

- Order backlog crosses INR 10,000 crore (INR 10,064 crore) mark in H1 CY2025 for the first time

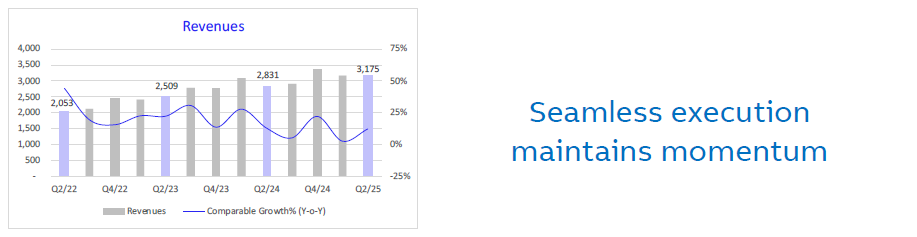

- 11th consecutive quarter of double-digit margins, impacted by forex fluctuations and one-offs in Q2 CY2025

- Received a "strong" rating from CRISIL reflecting the company’s robust environmental, social, and governance (ESG) performance

- The Board of Directors of the Company have declared an interim dividend of INR 9.77 per equity share of face value of INR 2 each

Commenting on the company’s performance, Sanjeev Sharma, Managing Director, ABB India said

“With strong revenue and backlog expansion, we have delivered yet another resilient performance for the second quarter and first half of the year. While profitability was impacted by forex volatility and one-offs during the quarter, we continued to deliver double-digit PAT margins for the 11th consecutive quarter. Cash position of the company remains healthy due to consistent efforts in collection. After strong growth periods, we experienced a cyclic correction in ordering activity that is seen across multiple sectors. However, we anticipate gradual uptick in demand, with easing inflation, and deeper market reach. Multiple sectors are expected to gain momentum in the near to the medium term. We are on track to achieve our sustainability targets with a special focus on water stewardship with the next level of stakeholder and supplier engagement. I am proud of the strong rating received on our sustainability performance – a testimony to the team’s dedication aligned with ABB Group’s sustainability agenda and targets.”

KEY FIGURES INR Crores (for continuing business)

Q2 2025 | Q2 2024 | Q1 2025 | H1 2025 | H1 2024 | CY 2024 | |

Orders | 3,036 | 3,435 | 3,751 | 6,787 | 7,042 | 13,079 |

Order backlog* | 10,064 | 9,517 | 9,958 | 10,064 | 9,517 | 9,380 |

Revenues | 3,175 | 2,831 | 3,160 | 6,335 | 5,911 | 12,188 |

EBITDA | 414 | 542 | 582 | 996 | 1,108 | 2,305 |

EBITDA % | 13.0 | 19.2 | 18.4 | 15.7 | 18.7 | 18.9 |

Profit before tax | 474 | 594 | 636 | 1,110 | 1,211 | 2,513 |

Profit before tax % | 14.9 | 21.0 | 20.1 | 17.5 | 20.5 | 20.6 |

Profit after Tax | 352 | 443 | 474 | 826 | 902 | 1,875 |

Profit after tax % | 11.1 | 15.7 | 15.0 | 13.0 | 15.3 | 15.4 |

Orders

Total orders for the quarter were at INR 3,036 crore and INR 6,787 crore for H1 CY2025. The second quarter witnessed some sluggishness in ordering activity coupled with a mixed bag of opportunities in the manufacturing sector. Order growth in Electrification and Motion was impacted by the timing of large orders, as we signed significant large orders for Datacenters in Electrification and for railway and metros in Motion in the same quarter last year, while base order grew. We saw some weakness in orders for Process Automation and Robotics and Discrete Automation. The period was marked with softer demand growth, rising input costs and continuing drag of geopolitical and trade uncertainty. Sectors like railways, metros, and two wheelers in transportation, mining, pulp and paper, paints, reliable power distribution equipment for industries, application for electronics, and energy efficiency system drives for industries contributed to growth.

Order Backlog

As of end of this quarter, ABB India continues to have a strong order backlog, for the first time reaching INR 10,000 crore mark in H1 CY2025 reaching INR 10,064 crore, distributed across segments, providing good revenue visibility, and is well aligned to support growth plans in the coming quarters.

Revenue and operations

The Company reported INR 3,175 crore revenue for the quarter and INR 6,335 crore for H1 CY2025. The company posted its highest second quarter revenue in the last five years. Significant step up in Electrification across divisions, especially export revenues, which was offset by softness in Process Automation. Process Automation witnessed a downslide due to large order revenues in Q2 CY2024 and delays in clearances and decisions in certain sectors. It is likely to fructify and stabilize in the coming quarters. Motion posted high revenues from drive products and traction business. Revenue growth in Robotics and Discrete Automation was led by the electronics sector.

During the quarter, ABB India and Steel Authority of India Limited (SAIL) signed a Memorandum of Understanding (MoU) to digitally transform operations at the Rourkela Steel Plant in Odisha. ABB India also brought to market a sleek, streamlined, and compact LV Titanium Variable Speed Motor platform with ability to cut setup costs and reducing material usage. The quarter was also marked by ABB’s large synchronous electric motor at an Indian steel plant achieving a world record in energy efficiency of 99.13%. The investment would likely have a payback period of only three months.

Profit and cash

The company reported a Profit before tax (before exceptional items) of INR 474 crore for the quarter and INR 1,110 crore for H1 2025 Y-o-Y. The operational EBITA for the quarter was INR 414 crore and H1 CY 2025 was INR 931 crore Y-o-Y. The profitability for the quarter was impacted due to forex volatility, especially on the import side, and one-off cost provisions in the Electrification segment.

Tax charges for the quarter were INR 122.0 crore with an Effective Tax Rate (ETR) of 25.7 percent and for the half year it was INR 284.0 crore with an ETR of 25.6 percent.

Profit after tax reported at INR 352 crore for the quarter, Y-o-Y, and INR 826 crore for H1 2025, Y-o-Y.

The company’s overall cash position continues to remain healthy at INR 5,154 crore at the end of Q2 and H1 CY2025 due to consistent efforts in collection. There was a short-term impact due to stocking-up of inventory to meet future delivery.

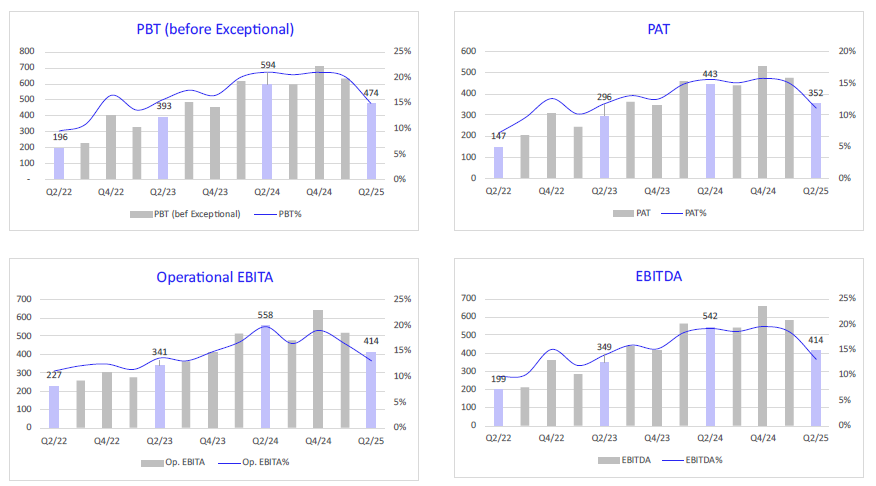

EPS

The Company reported an EPS of INR 16.62 for the quarter and INR 38.99 for H1 CY2025 reflecting the profitability of the operations.

Sustainability in practice

By the second quarter of 2025, the company successfully reduced greenhouse gas (GHG) emissions by approximately 87.5% compared to its 2019 baseline, marking a significant leap toward its climate goals. Currently, 50% of the company’s owned manufacturing sites have achieved water positivity and are certified as zero waste to landfill. Efforts to enhance sustainable operations are ongoing across the remaining sites, with continued initiatives focused on advancing water stewardship, achieving water positivity, and securing zero waste to landfill certifications. Comprehensive sustainability training was delivered to over 50 suppliers spanning multiple divisions, reinforcing our commitment to building an environmentally responsible supply chain.

Outlook

As India enters the second half of 2025, ABB India is strategically positioned to capitalize on a resilient macroeconomic backdrop and the accelerating pace of industrial transformation. The company’s broad-based portfolio is closely aligned with national priorities—ranging from energy transition and digital infrastructure to manufacturing competitiveness. In key sectors such as renewable energy, data centers, and power distribution, ABB India brings deep technological expertise and proven execution capabilities. While short-term private sector capex may see some moderation and cyclicity, structural demand—particularly in energy efficiency solutions for green hydrogen, HVAC, and clean energy—remains stable. Industrial automation especially in metals, mining, and oil & gas, is driven by the growing adoption of ABB’s AI-powered automation and electrification solutions. With a healthy order book, supportive policy environment, and rising electrification and automation intensity, ABB India is well-equipped to deliver sustained growth. Its strategic focus on localization, digitalization, and sustainability ensures resilience and agility in navigating macroeconomic shifts and global uncertainties while capturing emerging opportunities in India’s evolving industrial landscape.

Dividend

Based on the performance and the cash position, the Board of Directors have declared an interim dividend of INR 9.77 per equity share of face value of INR 2 each.

Operational update

For disclosures pertaining to the Company’s Robotics and Discrete Automation business, the communication filed with the stock exchanges may be referred,

ABB is a global technology leader in electrification and automation, enabling a more sustainable and resource-efficient future. By connecting its engineering and digitalization expertise, ABB helps industries run at high performance, while becoming more efficient, productive and sustainable so they outperform. At ABB, we call this ‘Engineered to Outrun’. The company has over 140 years of history and around 110,000 employees worldwide. ABB’s shares are listed on the SIX Swiss Exchange (ABBN) and Nasdaq Stockholm (ABB). www.abb.com