As any with a passing interest in shipping’s decarbonization journey will be aware, the Marine Environment Protection Committee meeting held in October postponed the International Maritime Organization (IMO) decision to adopt a Net-Zero Framework (NZF) to price ship carbon emissions from 2028 onwards.

A range of narratives have been offered to explain the conflicting positions taken by administrations at IMO, with lack of agreement expected to re-emerge at future meetings. Some also view the pause in regulatory action as a welcome opportunity to further refine details relating to the Net-Zero Fund proposal and fuel standards.

But the lack of regulatory consensus represents a further development hindrance for an alternative marine fuels market which is already burdened by high production costs, supply chain limitations and the lack of fuel standards. While the 2023 IMO decarbonization strategy remains in place, the postponement has consequences for the fuel choices ship owners make for their newbuilds and retrofits for the months and years ahead.

“Regulatory uncertainty can discourage investments by shipowners, ports, energy providers, and bunkering operators,” observes Charlotte Nonnemann, VP, Regulatory & Public Affairs, Marine Systems, ABB’s Marine & Ports division. “With the adoption, acceptance, and enforcement of the NZF subject to at least a one-year delay, expectations for widespread alternative fuel use by 2030 are fading.”

Charlotte Nonnemann, VP, Regulatory & Public Affairs, Marine Systems, ABB’s Marine & Ports division.

Jostein Bogen, Global Product Line Manager Electric Solutions, ABB’s Marine & Ports division.

Net-Zero Realism

One outcome of October´s proceedings appears to be a new realism among shipowners considering new investments, and a resolve to develop strategies that can accommodate a range of future decarbonization scenarios, says Nonnemann.

For the coming five years, she expects pragmatism to prevail in the face of regulatory uncertainty, as owners focus on efficiency gains that also secure decarbonization’s “low hanging fruit”.

Complicating matters is the fact that the EU’s Emissions Trading Scheme and FuelEU Maritime requirements are already in force. Owners and investors moving forward with newbuild or retrofit plans today will need assets which are adaptable to different decarbonization targets through a lifespan of 25 years or more, Nonnemann observes.

As industry watchers will know, the volatility that characterized the maritime markets through 2025 has by no means been bad for the freight and charter rates which drive the business of shipping. One irony of the loss of global regulatory impetus for green ship investments is that it coincides with a cash-rich moment for owners, with bankers also recovering their maritime appetites.

With opportunities better taken than missed, “plug and play” ship technologies which deliver cost- efficiency today and the flexibility to adapt to different decarbonization scenarios represent a sound investment, suggests Jostein Bogen, Global Product Line Manager Electric Solutions, ABB’s Marine & Ports division.

Future flexibility

“There is no doubt that regulatory uncertainty has impacted ROI decisions on green technologies, but demand for shipping services has not been diminished in the meantime: the need to optimize energy efficiency remains just as compelling,” Bogen says.

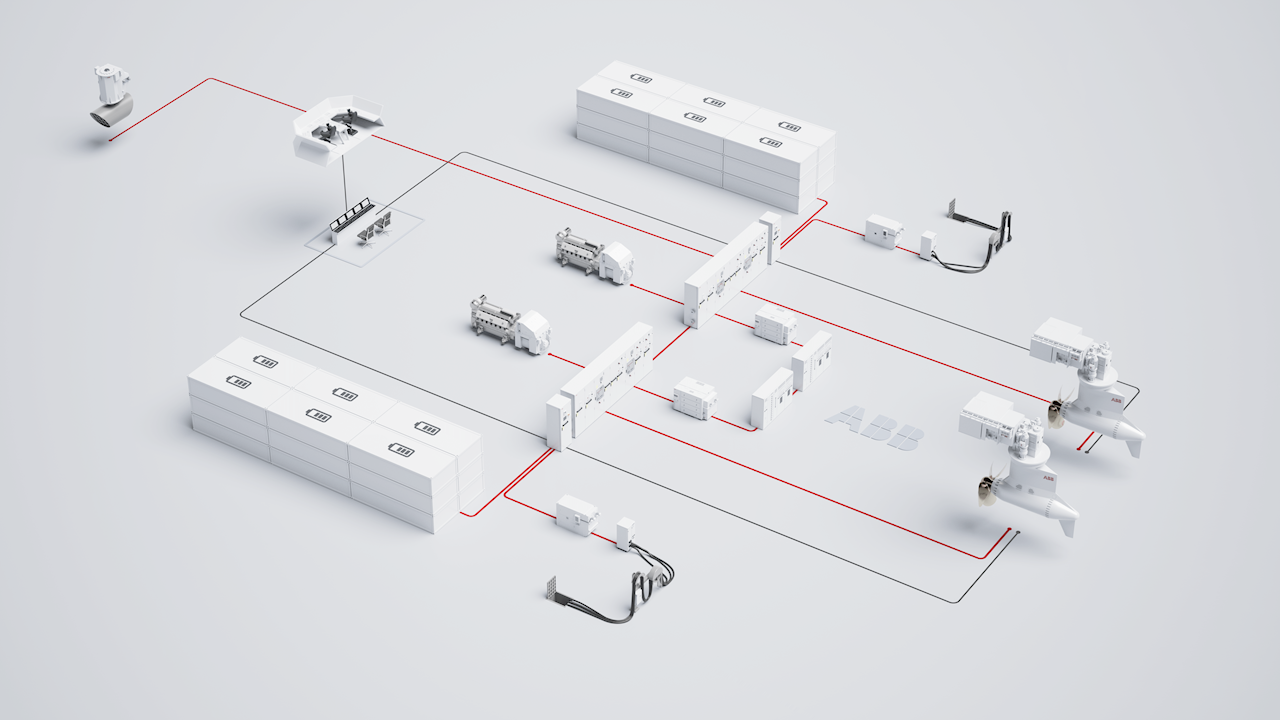

As a technology supplier dedicated to electric, automated and digital solutions, ABB’s long-term commitment to sustainability remains unchanged, but its systems are also wholly fuel-agnostic,” Bogen explains. “Cost efficiency is a permanent priority for customers, while our power and propulsion solutions support decarbonization independent of regulatory timelines.”

Fragmented regulations on ship emissions also make it more imperative to monitor, report, and analyze data to ensure voyage route efficiency matches charter terms, adds Bogen. “In the current situation, where regional and global regulators are out of step, owners need to be sure that their ships are and will be optimized for different outcomes.”

ABB’s power distribution and propulsion solutions can “plug and play” various energy sources, with generators running on multiple fuel types, battery power, fuel cells and even nuclear reactors, adds Bogen.

But rather than running through the technology options and compliance pathways, he emphasizes that it will be flexibility which safeguards investment.

“Actually, energy efficiency will always be part of the most reliable transition strategy, because it offers ROI regardless of fuel type or regulatory scenarios. Ship system flexibility is also constantly beneficial, but never more so than at the current time, where investors seek to hedge and future-proof vessels for new energy sources down the road.

”I don’t find it controversial to suggest that ships with an electric backbone offer that flexibility. Solutions which use electrification, automation and digitalization to optimize efficiency and are flexible to different fuel transition timelines are a practical way to handle current uncertainties.”

Images credit:

Adobe Stock

ABB