October-December Q4 and CY2025 HIGHLIGHTS

Q4 CY2025

All values are Y-o-Y with October-December Q4 CY2024 comparison

CY2025

Q4 CY2025 HIGHLIGHTS

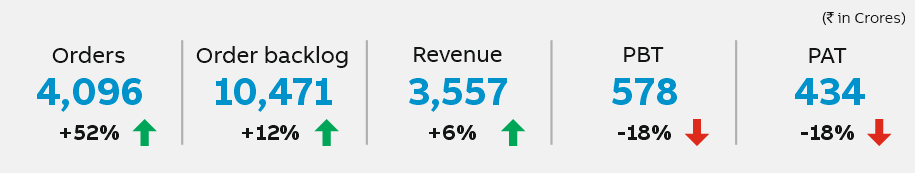

- Highest Q4 orders in last 5 years - up 52%; strong development in the base business with additional support from timing of large orders

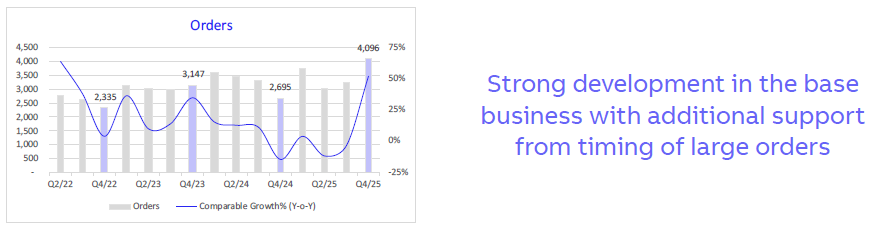

- Revenues grew across all business segments

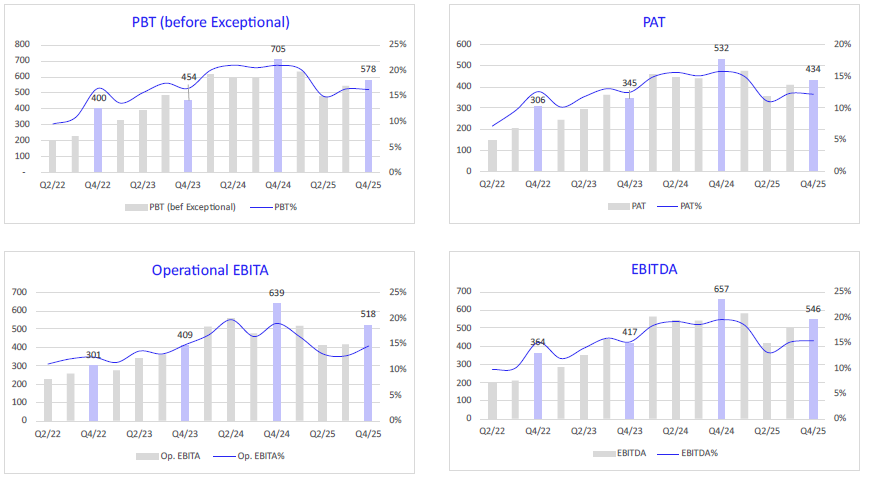

- PBT margin 16.2%, impacted by material‑cost inflation and increase in labor costs

CY2025 full year HIGHLIGHTS

- Highest ever orders of INR 14,115 crore and revenue of INR 13,203 crore

- Orders and revenue both up 8% for the year

- PBT margin 16.9%, amidst competitive intensity, currency and metal price headwinds, and higher Labor Code related expenses

- Return on capital employed (ROCE) at 21%

- Value chain sustainability advanced meaningfully, with ESG initiatives covering 51% of suppliers, with first ever certification for water stewardship with stakeholders for Nelamangala facility

- Board recommends a final dividend of INR 29.59 per share

Commenting on the company’s performance, Sanjeev Sharma, Managing Director,

ABB India said, “2025 was a year of steady progress for ABB India, underscored by the proud milestone of completing 75 years of manufacturing in the country. As we step into 2026, our record order book and highest‑ever revenues reflect the strength of our disciplined execution and the resilience of our teams. In the fourth quarter, we continued to ramp up orders and revenues despite margin pressures from volatile input costs. Our diversified portfolio and technology driven solutions allow us to navigate varied sectoral cycles with confidence, reinforcing the robustness of our business model. Customers rely on ABB for our innovation leadership, trusted partnerships, and an integrated ecosystem built over decades. Sustainability remains central to everything we do, and we continue to advance meaningful improvements across our operations, supply chain, and customer engagements. With strong leadership across divisions and a clear focus on agility, we remain committed to driving sustainable growth and long-term value for all stakeholders in the year ahead.” ‑driven solutions allow us to ‑term value for all stakeholders in the year ahead.

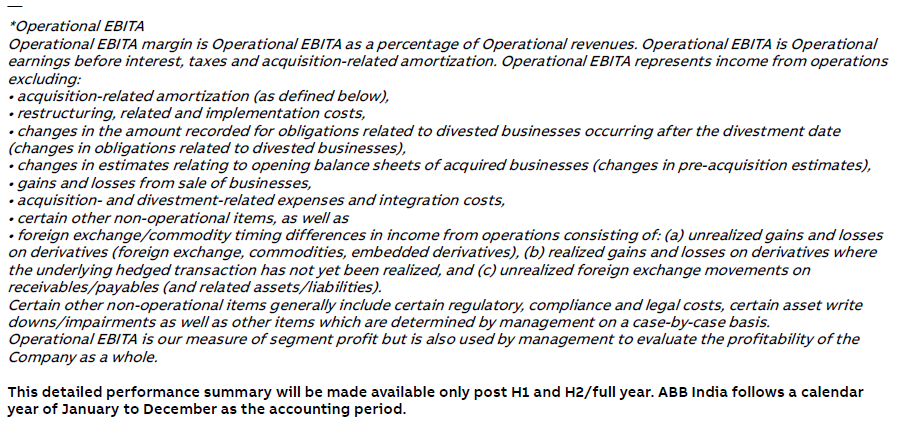

KEY FIGURES

Q4 2025 | Q4 2024 | Q3 2025 | CY 2025 | CY 2024 | |

Orders | 4,096 | 2,695 | 3,233 | 14,115 | 13,079 |

Order backlog | 10,471 | 9,380 | 9,895 | 10,471 | 9,380 |

Revenues | 3,557 | 3,365 | 3,311 | 13,203 | 12,188 |

Profit before tax | 578 | 705 | 542 | 2,230 | 2,513 |

Profit before tax % | 16.2 | 21.0 | 16.4 | 16.9 | 20.6 |

Profit After Tax | 434 | 532 | 409 | 1,669 | 1,875 |

Profit after tax % | 12.2 | 15.8 | 12.4 | 12.6 | 15.4 |

Operational EBITA* | 518 | 639 | 419 | 1,868 | 2,238 |

Operational EBITA% | 14.6 | 19.0 | 12.7 | 14.2 | 18.4 |

Orders

Q4 CY2025 had the highest fourth quarter orders in the last five years with total orders at INR 4,096 crore and for CY 2025 at INR 14,115 crore. During the fourth quarter, orders grew 52% due to a strong development in the base business with additional support from the timing of large orders. The quarter benefitted from large orders in the data center, automotive, building and infra, railways and metals segments.

For CY2025, orders momentum continued, up by 8%. In the last five years total orders have more than doubled.

Key orders during Q4 include:

- Low voltage switchgear for data center major

- Robotics solutions for a newly formed automotive company of an existing industrial major and an established auto major

- Propulsion systems for Indian Railways

- High current rectifier solutions for reliable, stable, ultra‑high current DC power for one of India’s largest infrastructure and manufacturing majors

- Automation energy industries solutions for electrical and instrumentation restoration for an engineering major

- Electric powertrain solution for a metals major

- Supply and local‐scope integration of a 34 MW Ethylene Cracker Compressor system for a large refinery project

ABB India continues to have a strong order backlog as of December 31, 2025, at INR 10,471 crore, an increase of 12% Y-o-Y, which provides revenue visibility and is well aligned to support growth plans in the coming periods.

Revenue and operations

The Company reported INR 3,557 crore revenue growth of 6% for the fourth quarter thereby achieving INR 13,203 crore for CY2025. All the business areas posted revenue growth during the quarter. In Q4, CY2025, Electrification marked higher export revenue from Distribution Solutions and Smart Power divisions, as well as all other divisions of Electrification business area registered revenue growth. In Motion, higher revenues across the divisions were offset by reduction in Motion Service division.

Export revenue remained a growth driver across all major business divisions. In Automation, higher revenue in the Energy Industries and Measurement and Analytics divisions was offset by reduction in Process Industries.

Profit and cash flow from operating activities

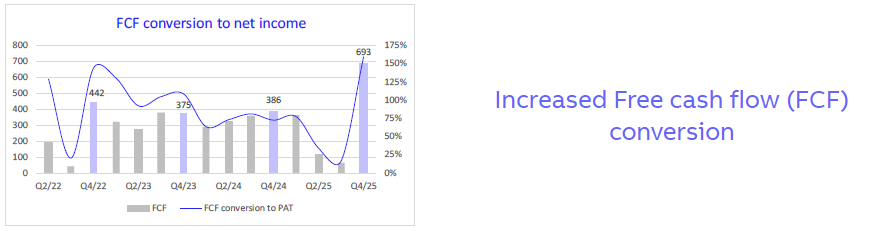

The company reported a Profit before tax (before exceptional items and one-offs) of INR 578 crore, for the quarter and INR 2,230 crore for CY2025. Profitability was affected by higher material costs, forex, QCO related imported material usage, and Labor Code impact, which was partly offset through commodity hedging and efficiency gains.

Income Tax expenses for the quarter was INR 143.3 crore with an Effective Tax Rate (ETR) of 24.8% and for the calendar year it was INR 560.5 crore with an ETR of 25.4%.

Profit after tax reported at INR 434 crore for Q4 CY2025, and INR 1,669 crore for CY2025.

The company’s cash position continues to remain robust at INR 5,694 crore at the end of Q4 and CY2025. The Net Working Capital increase is mainly witnessed in inventories which are consciously built to cater to the delivery of the backlog as per the agreed schedule.

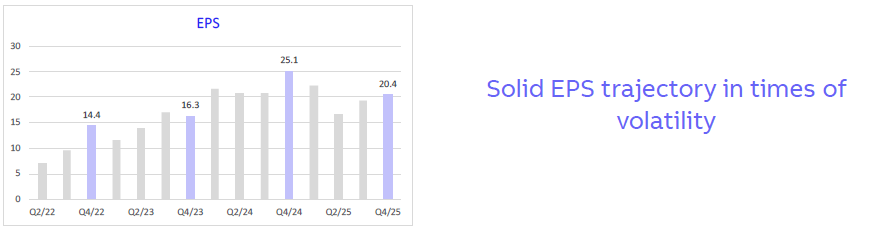

EPS

The Company reported an EPS of INR 20.43 for the fourth quarter and INR 78.73 for CY2025.

Dividend

The Board recommends a final dividend of INR 29.59 per share. The total dividend for CY2025 is at INR 39.36 per equity share, which includes an interim dividend of INR 9.77 per share.

Sustainability in practice

ABB India delivered strong progress against the ABB 2030 Sustainability Targets, supported by sustained collaboration across all sites and divisions. 70% of locations are now Zero Waste to Landfill and water positive, and 100% of factories achieved Platinum‑level IGBC certification by the end of CY2025. In a first for the ABB universe, the Nelamangala facility secured AWS accreditation, further strengthening the Company’s water‑stewardship and water positive credentials. Value‑chain sustainability advanced meaningfully, with ESG initiatives covering 51% of suppliers (by spend), alongside the smooth implementation of BRSR–ESG Version 2, enhancing the quality and transparency of disclosures. ABB India’s sustainability leadership continued to receive strong external recognition, including a GRIHA award for sustainability excellence, CRISIL’s No. 1 ESG ranking in the heavy engineering sector, and the National Stock Exchange’s ESG “Leader” rating.

Outlook

Entering 2026, ABB India is supported by strong demand momentum and a resilient local‑for‑local manufacturing base. The company’s diversified presence across 23 market segments positions it well to benefit from sustained investments in infrastructure, rail, grid modernization, and renewables, while also capturing opportunities in metals, mining, energy, chemicals, data centers, and electronics. Continued capex across chemicals, pharmaceuticals, automotive, power distribution, water, and digitalization align with ABB India’s core strengths and reinforces its long‑term growth outlook. The company continues to monitor global geopolitical developments and their influence on domestic demand, investment sentiment, inflation, FX, and climate‑related risks, while remaining focused on operational excellence, disciplined execution, and sustainable, profitable growth.

ABB is a global technology leader in electrification and automation, enabling a more sustainable and resource-efficient future. By connecting its engineering and digitalization expertise, ABB helps industries run at high performance, while becoming more efficient, productive and sustainable so they outperform. At ABB, we call this ‘Engineered to Outrun’. The company has over 140 years of history and around 110,000 employees worldwide.www.abb.com